Why Lemonade ($LMND) Could Be the Underdog Multi-Bagger Investors Need in Data-Driven Insurance

- Rebellionaire Staff

- Nov 20, 2024

- 2 min read

Why Lemonade ($LMND) Could Be the Underdog Multi-Bagger Investors Need

Lemonade ($LMND) just dropped a bombshell. They’re planning to grow their car insurance business by 36x in nine years. Yeah, you read that right—36 times. It’s bold. It’s ambitious. It’s very Lemonade. But what’s most intriguing is how this plan isn’t just about selling insurance; it’s about building a data empire.

Embracing Data-Driven Insurance: Lemonade's Competitive Edge

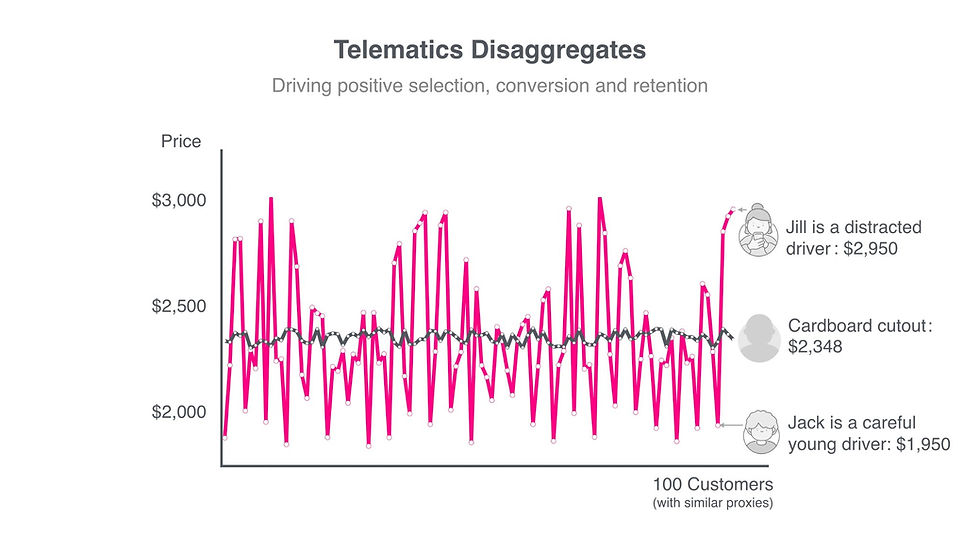

Bradford summed it up best: "Real world data is the new black gold." Every Lemonade car insurance policy sold isn’t just another notch on the sales belt—it’s a little data mine. They’re collecting real-world driving behavior, accident trends, and more. And here’s the kicker: this data doesn’t just fuel their insurance underwriting; it creates a competitive moat that traditional insurers simply can’t replicate. Lemonade's commitment to data-driven insurance allows them to tailor policies more accurately, reduce risks, and enhance customer satisfaction.

Data is the game now. Think of Tesla’s Full-Self Driving—years ahead because of all the real-world miles logged. Lemonade seems to be taking a page from that playbook, but in the insurance realm.

A 2.7x Rally, but Still Room to Run

Miss the recent 2.7x spike in Lemonade’s stock price? Don’t sweat it. Bradford teased a “secret bull case valuation” that hints at plenty of upside left. Multi-bagger potential isn’t just a pipedream—it’s built into their trajectory.

Here’s why:

Lemonade has shed its reputation as a cash-burning growth stock.

They’re guiding to stay cash flow positive, eliminating bankruptcy fears.

For a company scaling at this rate, having a positive cash flow is like turning on cheat codes in a video game. They can keep growing without constantly going back to the market, hat in hand, begging for more capital.

Growth No Longer Capital Constrained

This is where Lemonade flips the script on the bears. Bradford points out that their financing arrangements mean they can acquire as many customers as they want, focusing only on the ones that will be profitable.

Let that sink in:

For every dollar Lemonade spends on acquiring a customer, they expect $3 in profit.

And they’re projecting a 40% increase in new customer spend next year.

The result? A flywheel of growth, profitability, and reinvestment that no longer relies on external funding. Shorts who bet against Lemonade as a capital-hungry tech startup haven’t updated their playbook.

Why This Matters

Lemonade is transitioning from a scrappy disruptor to a data-driven insurance powerhouse. The company’s trajectory is increasingly tied to its ability to leverage data in ways competitors can’t. And as they grow their moat, their ability to attract and retain customers becomes self-reinforcing.

The Takeaway

Is Lemonade still risky? Sure. No company aiming for a 36x expansion in nine years is playing it safe. But with profitability now guiding their path and data as their not-so-secret weapon, the upside is too compelling to ignore.

Bradford’s take? Lemonade’s not just another insurance stock—it’s a potential multi-bagger in the making. So, buckle up. Things could get interesting.

And if you want more insights like this, stay tuned for the “secret bull case valuation” coming soon from Rebellionaire. You won’t want to miss it.

Comments